Why are SCHD & SCHY ETFs good to invest long term?

- Simple, just buy and hold and get dividend

- Low fee

- Pay high dividend consistently and also have potential to grow dividend

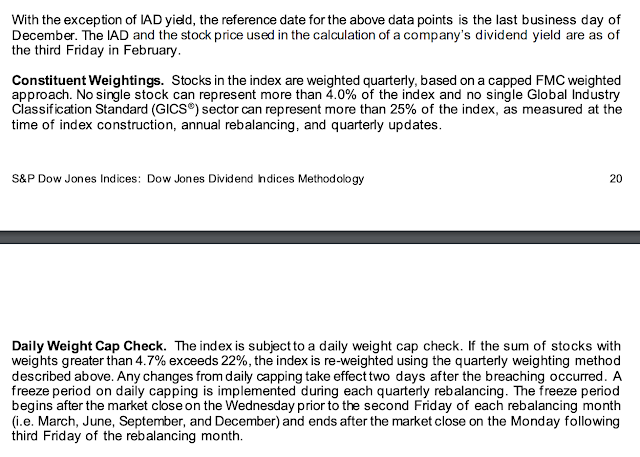

- Diversify to stocks around the world

- SCHD is an index fund of "Dow Jones U.S. Dividend 100 Index" and SCHY is an index fund of "Dow Jones International Dividend 100 Index", which inclusion and rebalance criteria are simple and make sense

Dow Jones International Dividend 100 Index [4]

Schwab U.S. Dividend Equity ETF [7]

- Symbol: SCHD

- Total Expense Ratio: 0.060%

The fund’s goal is to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100™ Index.

- A straightforward, low-cost fund offering potential tax-efficiency

- The Fund can serve as part of the core or complement in a diversified portfolio

- Tracks an index focused on the quality and sustainability of dividends

- Invests in stocks selected for fundamental strength relative to their peers, based on financial ratios

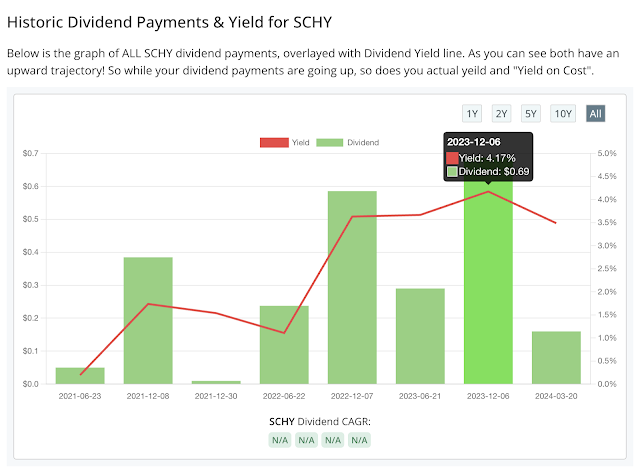

- Symbol: SCHY

- Total Expense Ratio: 0.140%

The fund’s goal is to track as closely as possible, before fees and expenses, the total return of an index composed of high dividend yielding stocks issued by companies outside the United States.

- A straightforward, low-cost fund offering potential tax-efficiency

- The Fund can serve as part of the core or complement in a diversified portfolio

- Tracks an index focused on the quality and sustainability of dividends by screening non-U.S. companies based on four dividend quality attributes

- Invests in non-U.S. high dividend yielding stocks with a record of paying dividends for at least 10 consecutive years, financial strength and screened for lower volatility

Historical Dividend Payments [6]

References

[1] FMC: Free Market Cap: https://cleartax.in/glossary/free-market-capitalism-fmc/

[2] IAD Yield: Indicated Dividend Yield: https://www.investopedia.com/terms/i/indicateddividend.asp

[3] ADVT: Average Daily Volume Traded: https://www.acronymfinder.com/Business/ADVT.html

[4] Dow Jones Dividend Index Methodology: link

[5] SCHD Dividend Calculator: https://www.dripcalc.com/?tkr=SCHD

[6] SCHY Dividend Calculator: https://www.dripcalc.com/?tkr=SCHY

[7] SCHD ETF: https://www.schwabassetmanagement.com/products/schd

[8] SCHY ETF: https://www.schwabassetmanagement.com/products/schy

ผมเข้ามาเจอที่นี่โดยบังเอิญ ชอบบทความต่างๆ

ตอบลบอยากถามเรื่อง DR ครับ ผมตรวจสอบหมดแล้ว ว่า ค่าใช้จ่ายที่โบรก เก็บจาก DR มีอะไรบ้าง ตรวจละเอียดเลยนะ รวม ทั้งดูหนังสือชี้ชวนด้วย

แต่บางคนเขาว่า ยังมี ค่าบริหาร ซ่อนอยู่อีก จริงหรือ

คือ ผมจะซื้อ DR ผมก็ต้องรู้หมดว่า มีค่าอะไรบ้าง ผมรับได้หรือไม่ได้

เท่านี้ละครับที่ผมขอรบกวนครับ